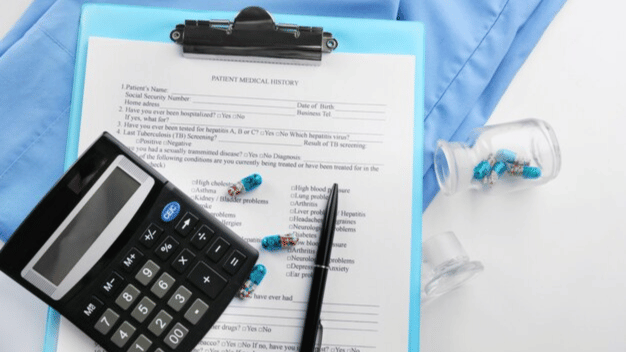

A medical billing audit is a systematic review of healthcare providers’ billing processes. It involves examining patient records, coding practices, and claims submissions to ensure that all services are billed accurately. This process helps identify discrepancies, coding errors, or compliance issues, allowing healthcare providers to correct them before they result in denied claims or legal complications.

Why Are Medical Billing Audits Important?

Medical billing audits are not just about compliance; they are about enhancing the entire billing process. Here’s why they matter:

- Compliance and Legal Protection:

- Regulatory bodies like Medicare and Medicaid have strict billing guidelines. Audits ensure adherence to these rules, minimizing the risk of penalties, fines, or audits by external agencies.

- Revenue Optimization:

- Errors in billing can lead to claim denials or underpayments. An audit helps uncover these mistakes, allowing providers to correct and resubmit claims, leading to better revenue collection.

- Improved Patient Trust:

- Accurate billing reflects professionalism and builds trust with patients. Patients are more likely to feel confident in a provider’s services when they know their bills are handled accurately.

- Enhanced Operational Efficiency:

- By identifying inefficient practices or recurring errors, audits help streamline the billing process, saving time and reducing administrative burdens.

Types of Medical Billing Audits

There are primarily two types of medical billing audits:

- Prospective Audit (Pre-Bill Audit):

- This type of audit is conducted before the claim is submitted. It helps identify and correct issues early, reducing the likelihood of claim denials.

- Retrospective Audit (Post-Bill Audit):

- This audit takes place after the claims have been submitted. It focuses on reviewing past claims for accuracy, helping to identify trends in errors that may need addressing.

How is a Medical Billing Audit Conducted?

A medical billing audit typically involves the following steps:

- Selection of Sample Claims:

- Auditors choose a sample of claims from various services and departments for review.

- Review of Patient Records:

- The selected claims are compared against patient records to verify the accuracy of coding and billing.

- Analysis of Coding Practices:

- Auditors check for correct use of ICD-10, CPT, and HCPCS codes. Incorrect coding is one of the most common issues uncovered during audits.

- Reporting and Recommendations:

- The findings are compiled into a report, highlighting errors, areas of improvement, and actionable recommendations for enhancing the billing process.

Benefits of Regular Medical Billing Audits

Conducting regular medical billing audits brings several key benefits:

- Reduced Risk of Fraud:

- Audits help detect and prevent fraudulent billing practices, safeguarding the provider against legal issues.

- Better Cash Flow:

- By identifying billing errors that cause claim denials, audits help maintain a steady revenue stream.

- Increased Staff Training:

- Audit results can be used to train billing and coding staff, reducing future errors and improving overall efficiency.

Best Practices for Effective Medical Billing Audits

To get the most out of a medical billing audit, healthcare providers should follow these best practices:

- Implement Regular Audits:

- Conduct audits quarterly or semi-annually to stay on top of any emerging issues.

- Use Technology:

- Employ automated billing software and electronic health records (EHRs) to streamline the audit process and reduce manual errors.

- Engage Qualified Auditors:

- Hire experienced auditors who understand the nuances of medical coding and healthcare regulations.

- Focus on Education:

- Use audit findings as a learning opportunity for staff, ensuring continuous improvement in billing practices.